Executive summary

Pricing and billing can be a barrier to achieving full-stack, end-to-end observability. Historically, most observability vendors have used host- and telemetry-based pricing and subscription-based billing. This begs the question of how vendors price and bill observability platforms and whether the observability landscape needs a pricing overhaul.1

Which pricing and billing models support full-stack observability for engineering teams who build and maintain software on distributed and hybrid architectures? This white paper explores the options available and why usage-based pricing and billing enable organizations to align observability practices with business outcomes better than alternatives.

It provides an overview of the software pricing and billing models used by observability vendors today. It also defines and compares the various software ecosystems, business models, pricing models, pricing options, billing models, and buying programs for commercially available observability platforms.

Finally, it reviews why usage- and user-based pricing and usage-based billing are better than host-based pricing and subscription-based billing for observability platforms and tools. And how usage-based pricing and billing can provide more value through benefits such as cost transparency and spend scalability, predictability, and flexibility.

How observability is priced and billed

Observability vendors must consider several factors in their pricing and billing approach, including the business model, software ecosystem, pricing model, pricing options, billing model, and buying programs. Therefore, consumers need to understand the options available in the observability marketplace today.

Business models: On-prem vs SaaS

A business model describes how a product is structured. Observability vendors typically use an on-premises (on-prem) business model, a software-as-a-service (SaaS) business model, or a combination of both, with SaaS being the most common.

- On-prem solutions are hosted in-house and are usually supported by a third party. They are tied to a particular building or premises, require a significant upfront capital investment plus ongoing maintenance and support costs, and depreciate in value over time. For on-prem solutions, customers purchase a perpetual or term license to the software that’s installed and used locally.

- SaaS solutions are hosted and maintained by a third party in the cloud (also known as cloud computing). They can minimize costs for internal resources and information technology (IT) support. SaaS solutions are delivered either on a pay-for-use basis or as a subscription. For SaaS solutions, customers purchase a term license to the software that’s not installed locally but instead is run in the vendor’s cloud.

Compared to on-prem solutions, customers who use SaaS solutions typically have lower upfront, upgrade, and maintenance costs and are more scalable, among other benefits. SaaS organizations can also measure customer engagement and usage, and leverage that data to inform product development. SaaS is a better option for growing customers and customers with limited staff or a large amount of data or old hardware.

The International Data Corporation (IDC) expects the cloud services segment, representing IT operations analytics (ITOA) software delivered via public cloud, to exceed US$3.2B by 2025 and reflects a five-year compound annual growth rate (CAGR) of 20%. Conversely, IDC expects the on-prem software market to decrease to 46% of the market by 2025, down from 66% in 2020.2

SaaS organizations are on the rise, aided by the rapid growth of the cloud computing market. Many software vendors—including observability vendors—have adopted a SaaS strategy, such as Adobe, Amazon Web Services (AWS), GitHub, Google, Marketo, Microsoft, Salesforce, Twilio, Slack, Zendesk, and more. Notably, New Relic and Splunk are the only observability vendors to make the “Top 75 SaaS Companies of 2022” list.3 A survey by Finances Online suggests that 86% of organizations will be running entirely on SaaS by 2023. It also found that 40% of respondents said cost was the biggest challenge for organizations engaged with SaaS.4

Most observability vendors are purely SaaS or a combination of SaaS and on-prem; none are on-prem only.

Software ecosystems: Closed vs open

A software ecosystem includes individual software applications that are interconnected and can be either closed or open.

- Closed software ecosystems have a gatekeeper, usually a single organization, that controls and limits the services, software, or hardware that can work with the system. Generally, a software company develops a proprietary suite of applications that typically cannot communicate with other applications outside the system. Users usually cannot customize or easily extend a closed software ecosystem, which usually requires vendor lock-in.

- Open software ecosystems have no single gatekeeper controlling access, so the system is open to all. Open system vendors assume customers need to bring data from multiple sources and make that as economical as possible by allowing others to edit, modify, and adapt certain software components. Virtually anyone can build on an open system, often using open-source code. An open system can include components that are open as well as closed. The collaborative open-system approach helps meet continually evolving needs. Open systems are more flexible than closed systems and usually do not require vendor lock-in.

According to an article in Electronic Design, “In the new world of collaborative engineering, only the companies who participate in and help create engaged, open ecosystems will survive. In turn, closed platforms will inevitably become obsolete.”6

Pricing models: Infrastructure- vs service- vs user- vs telemetry-based

Pricing models include the unit of measurement(s) by which a vendor meters product usage. They can be either quantity-based or usage-based. Observability vendors use a combination of the following pricing models:

- Infrastructure-based pricing (also known as host-based pricing or agent-based pricing in the observability world) is based on the number of units that make up the underlying infrastructure of the tech stack being monitored, such as hosts, agents, and nodes. It is quantity-based.

- Service-based pricing is based on the number of services being monitored. It is quantity-based.

- User-based pricing is based on the number of provisioned users, such as engineers and developers using the monitoring tool or observability platform, and can include different user types for flexibility. It is quantity-based.

- Telemetry-based pricing is based on the amount of data being collected (data ingest), usually measured in gigabytes (GB). In addition to data ingest, it may include storage and queries measured in spans and metrics, including custom metrics or metric data points per minute (DPM). It is usage-based.

All observability vendors use a hybrid approach that combines usage-based and quantity-based pricing—telemetry-based pricing in combination with either infrastructure-, service-, or user-based pricing.

In addition, observability vendors use two common pricing approaches, including a:

- Single, consolidated observability platform where organizations pay one price for access to all observability capabilities (now and in the future) or

- Bundle-of-SKUs approach where organizations must pick and choose which observability capabilities they want and pay for them individually.

The single-platform and bundle-of-SKUs approaches were neck and neck in the 2022 Observability Forecast. Budget-friendly pricing ranked the most important overall (36%); transparent pricing (31%), a single license metric across all telemetry (30%), and having a low-cost entry point (27%) were also frequently cited.7

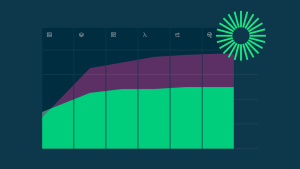

Pricing feature preferences

Most observability vendors also offer different pricing editions, tiered pricing, and buying programs to help provide customers with the best pricing to fit their needs.

Infrastructure-based pricing

Infrastructure-based pricing, including host-based and agent-based pricing, usually involves a bundle-of-SKUs approach with per-product pricing for different types of monitoring. Observability vendors that use infrastructure-based pricing usually price per SKU per quantity each for a monthly use-it-or-lose-it amount. SKUs (often 16+) can have multiple different units and pricing modifiers, such as hosts, agents, nodes, AWS Fargate tasks, CPU cores, containers, custom metrics, events, and API/browser tests.

Modern architectures built on managed cloud services often have increasingly abstracted underlying infrastructures. Purely abstract workloads completely remove the concept of hosts, and teams run code without provisioning or managing servers. So, for cloud vendor services that have abstracted the underlying hosts completely, such as AWS Fargate and AWS Lambda, counting hosts isn’t easy.

In addition, charging per container places a configuration burden on engineering teams since some observability vendors (like Datadog 8) charge a premium for more than four containers running continuously on an application performance monitoring (APM) host, which is extremely common.

Another thing to consider is whether the vendor forces customers to bundle adjacent use cases. This could mean that if an organization wants just APM, they have to sign up for infrastructure monitoring as well. For example, Datadog requires customers to have infrastructure monitoring for every billable APM host, which would increase an organization’s APM costs by the cost of the monitoring infrastructure as well.9

Datadog also requires customers to commit to higher APM costs for all their hosts when they want to use continuous profiling for as little as one APM host.10 So customers can’t mix and match. This all-or-nothing approach could increase the APM cost by up to 29%.

Similarly, Datadog requires customers to enable distributed tracing for APM to generate golden metrics.11 Distributed tracing often accounts for the most data in a customer’s observability environment. So, forcing customers to use distributed tracing by default can have a substantial impact on the total APM cost.

Additionally, some vendors with a SKU-per-use-case model under a committed contract don’t support substituting SKUs before the end of the term, which results in shelfware.

In addition, if an organization pays for 100 APM hosts and then realizes that they only need 50, some vendors don’t allow them to switch those 50 APM hosts to another use case if circumstances change until the end of the contract term (they’re locked in).

The complex bundle-of-SKUs approach requires customers to forecast their usage based on historical usage, which can be challenging, especially for those who are experiencing rapid growth. The forecasting process also can take months. This complex forecasting can be further frustrating when hit by surprise overages.

Because infrastructure-based pricing commitments assume linear license consumption and are based on individual products, it has no predictability for scaling. This assumption isn’t realistic; modern/ephemeral infrastructure changes with demand. As an organization scales, it may want to avoid individually negotiating and paying for each SKU with different pricing models and traps.

In addition, paying for the number of servers and hosts is challenging in distributed environments of microservices, containers, serverless, and so on. The number of hosts/services is exploding. Hosts can double every two to three years. Cloud adoption can increase the number of hosts 20–50x:

- Data centers deploy high-core physical servers.

- Cloud deployments favor small virtual machines (VMs) or servers.

- One big physical data center server becomes 20–50 cloud VMs/instances.

- Per-host cost can grow from US$15/month to US$300–US$750/month.

As organizations increase their monitoring coverage, they have a stair-step expense to an unbounded amount. That forces them to pay a lot for every incremental host/service or leave blind spots.

With infrastructure-based pricing, many organizations only partially instrument their environment—also known as data sampling—so they can’t get full visibility into their entire tech stack. Sampling data forces organizations to bet that they’ll catch the abnormal behavior in the sample, which may or may not happen.

Most observability vendors—including Cisco AppDynamics,12 Datadog,13 Dynatrace,14 Elastic,15 and Splunk16—use host-based, agent-based, node-based, and other types of infrastructure-based pricing. All combine infrastructure-based pricing with telemetry-based pricing (hybrid).

The fact that hybrid host- and telemetry-based pricing is the most common pricing model for observability vendors may account for why 34% of 2022 Observability Forecast respondents said they prefer it.17

Service-based pricing

Service-based pricing is price based on the number of active services. An active service is a single component of a software application, often a microservice, that provides specific functionality. Examples include an authentication and checkout service.

The challenges of service-based pricing are similar to those mentioned for infrastructure-based pricing above. In addition, services may change more frequently than engineering team structures, which introduces more variables and can make it hard to forecast. And in distributed systems, it can be difficult to understand the full scope of services and interdependencies between them, which can result in being billed for non-critical or deprecated first- or third-party services.

Only a couple of observability vendors offer service-based pricing along with telemetry-based pricing.

User-based pricing

Scaling up on a user-based pricing model is simpler and much more cost-effective and predictable than traditional infrastructure- and service-based pricing models. Anchoring pricing on a stable metric like users provides more predictability and control for observability spending (every department budgets for headcount).

In addition, headcount typically grows much more slowly than infrastructure and data. As data volumes explode and staffing doesn’t, a user-based pricing model gives organizations a durable advantage, while other pricing models can become prohibitively expensive. User-based pricing is one of the most predictable pricing metrics used by the majority of enterprise cloud applications across the SaaS industry, aligning value directly to the engineers and developers empowered by its use.

For example, 50% of SaaS organizations determine price based on the number of users.18 However, only one observability vendor—New Relic—offers user-based pricing (in combination with telemetry-based pricing).19

The ratio of cost to value is not linear—it’s actually more exponential. The more users with full-stack observability access at an organization, the greater the network effect that enables teams to solve problems in context on a single version of the truth. Value increases as users increase, and the cost associated with those users decreases as they reduce mean time to detection (MTTD) and mean time to resolution (MTTR).

Software vendors that price by users usually offer different user types so customers can give access to engineers and developers based on their needs and only pay for what they need. For example, New Relic enables organizations to provide every engineer and developer access to alerts, dashboards, queries, and basic logs for free through its unlimited basic users.20 If engineers and developers need additional access, organizations can upgrade basic users to core users or full platform users, depending on their needs. In addition, new users get metered at decreasing rates on a tiered basis by some software vendors. Tiered user pricing and buying programs can offer additional flexibility and help support the broadest engineering coverage possible so that organizations don’t have to sample users.

Another benefit of a user-based pricing model like that of New Relic is that full platform users can get access to everything today and in the future. This makes it easy to try and use new features and capabilities and also can be more cost-effective to pay one price for all observability capabilities instead of paying for each capability ad hoc.

With a user-based pricing model, organizations only pay for users once. With infrastructure- and service-based pricing models, even from the same vendor, organizations must pay for user access more than once with each host/service they add (hidden cost). So, it’s not surprising the 2022 Observability Forecast found that 34% of respondents favor hybrid user- and telemetry data-ingestion pricing—even though it’s the least common model for observability vendors.21

Telemetry-based pricing

Telemetry-based pricing is a metered or usage-based pricing model (also known as consumption-based pricing and data ingestion-based pricing) that aligns usage with spend. It improves customer satisfaction by quantifying the value of the provided product or service and creating a durable growth driver. It’s especially helpful for products that deal with bandwidth or API requests.

For data ingest, usage-based pricing enables organizations to pay only for what they use, giving them greater control over their budgets. Forecasting usage is tied to data.

Customer-centric consumption pricing is based on cost transparency, which can create a strong sense of partnership between customers and vendors. With usage-based pricing, organizations no longer have to predict upfront how much data they will use over the next year(s) and deal with shelfware if they use too little or penalties if they use too much.

Usage-based pricing can also help eliminate barriers to adoption. It’s one of the fairest pricing strategies as it enables organizations to start with a low cost based on their initial usage, and the cost grows only according to the value they derive from the product.22 This is key since more than a quarter (27%) of the 2022 Observability Forecast respondents said that a low-cost entry point is the most important pricing feature for their observability tools/platform.23

Observability vendors that incorporate usage-based pricing can align and grow with customer needs and offer predictability. According to a Subscribed Institute benchmark, organizations with usage-based pricing that makes up between 1–50% of their overall revenue grew at 28% year-over-year (1.5 times higher than organizations with no usage-based pricing).24 Usage-based pricing is a win-win for observability vendors and customers alike.

However, only 38% of SaaS organizations price based on usage25 even though organizations with usage-based pricing grow 38% faster.26 But usage-based pricing is on the rise and quickly becoming the most preferred pricing model for SaaS organizations.27

According to an article by Enterprise Talk, observability vendors are moving toward engineer-centric, usage-based consumption and pricing models to provide teams with complete visibility into their telemetry data while only charging them for what they use: “This approach helps engineers acquire a comprehensive picture of their operations and realize the benefits of true observability by removing upfront speculation on usage and potential overage penalties.”28 Tech teams can instrument more telemetry points and achieve stronger results without allocating more budget.

All observability vendors use telemetry-based pricing for data ingest. However, they combine telemetry-based pricing with either infrastructure-, service-, or user-based pricing for a hybrid approach.

Data is the biggest variable cost for observability. As organizations shift from on-prem to cloud and microservices, there can be hundreds of small programs instead of a few large programs. Customers generally report 2–10x telemetry data increases or more. And data can double every two to three years—a data explosion. The associated network, storage, and compute costs can add up quickly. Therefore, it’s important to future-proof cloud adoption by looking for an observability vendor that offers a low data cost per GB. And, to reduce the amount of data ingested (and data ingest bills), organizations should be able to manage their data ingest by configuring data-dropping rules that filter out unimportant, low-value data and potentially sensitive data.

In addition, some observability vendors price ingestion, retention, indexing, and rehydration separately, while some bundle them together. So it’s also important for organizations to factor that in when shopping for an observability solution to avoid billing surprises. For instance, the data retention cost can be orders of magnitude larger than the data ingestion cost (as with Datadog logs pricing29). A low data ingest cost can be deceptive if organizations do not account for additional indexing, retention, and rehydrating costs. One out of three of the 2022 Observability Forecast respondents said a single license metric across all telemetry was the most important pricing feature for their observability tools/platform.30 Full data transparency and ingestion controls are key. For example, New Relic data pricing encapsulates ingestion, query, and storage; it is available at a competitive price to help customers get full coverage across their entire estate.31

Another variable to consider is how the vendor handles seasonality, blue/green deployments (also known as canary deployments), and traffic spikes. Some observability vendors (like Datadog32 and Splunk33) price by high watermark (peak) usage instead of by average usage. In a world where infrastructure scales up and down with customer demand, charging at a peak rate is predatory as spikes can double the bill. Ideally, organizations should only pay for what they use instead of paying for peak usage all month.

They should also be able to create an alert when usage exceeds a fixed monthly threshold for gigabytes. However, they should not have to establish daily quotas that don’t break down during peak and seasonal periods, so they don’t have to adjust quotas constantly.

Pricing editions

Almost all observability vendors also offer different pricing editions—such as standard, professional, and enterprise, or silver, gold, and platinum—to help provide customers with the best pricing to fit their needs. Think of good, better, and best. Pricing editions typically offer different price points based on access to different features and limits.

For example, a standard edition might offer just the basics, while a professional or enterprise edition might offer higher limits (on things like synthetic monitor checks and extended data retention), security and technical support features (such as HIPAA- and FedRAMP-enabled environments and faster support), and buying program options for a higher price.

Tiered pricing

Tiered pricing means that higher numbers of billable users can unlock lower costs for a predictable spend that scales. The prices and tier levels may vary depending on a customer’s specific contract. Here’s an example of how tiered pricing might work for an observability vendor that has tiered pricing for users:

- Users #1–10 at price x

- Users #11–20 at price y (lower than x)

- Users #21–30 at price z (lower than y)

New Relic is the only known observability vendor to offer tiered pricing (for billable users).34

Billing models: Subscription- vs usage-based

Pricing and billing models are the purest form of connection between the success of a business and that of its customers. Most observability vendors use one of two billing models:

- Subscription-based billing is based on a monthly or annual fee to access the platform, so you must commit to a specific amount upfront (beginning of the billing cycle). Subscription-based vendors prioritize maximizing customers’ committed spend.

- Usage-based billing (also known as consumption billing) is based on units of usage, so you pay only for what you use (end of the billing cycle). Usage-based vendors prioritize driving customers’ usage of a product.

The 2022 Observability Forecast found that respondents preferred usage-based billing models (whether usage is based on monthly provisioned use or active use) over subscription-based for their observability tools/platform.35 However, AWS CloudWatch and New Relic are the only observability vendors that offer usage-based billing.

Zuora founder and CEO, Tien Tzuo, notes that the best models combine subscription- and usage-based models: “A predictable fee for some level of service, and then pay-as-you-go if you need more...It’s the best of both worlds, finding the right balance between flexibility and predictability.” Tien adds that New Relic is one of the best examples of this.36

According to the 2022 Observability Forecast, the top billing preference overall was the flexibility to scale usage based on consumption with no monthly minimum (38%). Predictable spending and the ability to ingest any telemetry data type and autoscale with no penalties also ranked high. In fact, “In supplemental interviews with IT decision-makers (ITDMs) by Enterprise Technology Research (ETR) during the execution of this study, interviewees most commonly desired predictability in pricing and billing. No matter the technical design of a pricing or billing model, ITDMs desired the ability to predict accurately what the bill would be in advance.”37

Billing feature preferences

Subscription-based billing

Many SaaS organizations use subscription-based billing. According to a 2021 report by the Subscribed Institute, the subscription economy grew more than 435% over the last nine years.38

Organizations that use this model generate recurring revenue through auto-renewals and commitment contracts. Vendors base discounting on committing to future license requirements, often one to three years out, which works best when future demand is highly predictable. While it can provide a more predictable revenue stream for budgeting and revenue forecasting, subscription billing can be especially cumbersome for products that include five or more licensing and pricing metrics. Each metric requires a separate license quantity commitment negotiation. Many observability vendors that use infrastructure-based pricing with a different SKU for each observability capability face this challenge.

Subscription-based billing for enterprise software is designed to maximize committed shelfware, which is software that was paid for but not used. While using too little of their commit results in shelfware, on the flip side, using too much usually results in overage penalties. This is beneficial for vendors but is not advantageous for customers. Customers deserve stronger value than what subscriptions can provide.39 Most observability vendors offer subscription-based billing.

In addition, a best practice for solutions that use subscription-based billing is providing tools to query, track, and alert on billing-related usage. Such tools can help avoid overage penalties and make accurate sizing and pricing easier. Unfortunately, not all observability vendors provide this.

Usage-based billing

Usage-based billing unlocks a more truly shared objective between vendor and customer—an accurately sized commitment with continuous support to ensure full use. Commonly used for infrastructure services and cloud computing, usage-based billing offers flexibility, affordability, and often a lower initial commitment, providing customers with options that are in line with their perceived value of the product.40

A 2021 playbook by OpenView states that a usage-based model enables customers to:

- Start at a low cost, reducing potential contracting friction.

- Directly link the price paid with the value received.

- Provide more users access to the product within an account, making the software more ubiquitous and seeding new use cases.

- Expand the total addressable market (TAM) by making the product more accessible while uncapping the potential upside.41

Public SaaS companies with the strongest net revenue retention are disproportionately likely to employ a usage-based model. Monetization comes after the customer has seen value rather than acting as a gating mechanism.

This model incentivizes vendors to monitor adoption behavior consistently, invest in new features that make the product more valuable, and proactively address any at-risk accounts.42 Plus, with a usage-based model, the account team is invested in customer success and stays engaged after the sale to ensure that customers consume and find the consumption valuable. So, the sale is just the beginning of a long-term relationship.43

With a usage-based model, vendors don’t get paid until after customers have adopted the product, so there’s no risk to trying before they buy. All observability vendors offer free usage credits (freemium) to make it easier for customers to do this. When new customers get hooked and add additional users, there’s a stronger foundation for future customer growth. Customers constantly choose how much and when to use the product, and they only pay when they’ve seen results. In other words, vendors tie success to customers’ perceived value—it’s a win-win for both.

A usage-based billing model drives usage, eliminates shelfware, and enables customers to pay as they grow (or pay as they go). Despite its many benefits, only two observability vendors offer usage-based billing (AWS CloudWatch and New Relic).

At New Relic, we believe the reason that a usage-based model is the way forward for software is because it changes the fundamental nature of the relationship between the vendor and the customer; the vendor understands that if they don’t build great products that customers enjoy using, they won’t get paid.44

According to 2022 Observability Forecast respondents, the most important billing feature is the flexibility to scale usage based on consumption with no monthly minimum. The ability to ingest any telemetry data type and autoscale with no penalties also ranked high.45 True observability requires delivering end-to-end, full-stack visibility at scale, including infrastructure, application, and customer experience. This requires scaling to any telemetry data with high cardinality and high dimensionality without punitive costs. As observability strategies evolve, adding technical- and business-specific information maximizes investment.

Buying programs

Another factor for organizations to consider is the available buying programs, also known as buying plans or usage plans, which apply to customer commitments and billing scheduling options and terms. They govern how vendors handle billing schedules. Some common buying program options used by observability vendors include pay as you go and commitment contracts. Each option may only be available for certain pricing editions.

Pay as you go

With this option, customers commit to paying for the product on a month-to-month consumption basis. Billing typically happens at the end of each calendar month. There are no payment commitments past the current month, and customers can cancel at any time. It may offer one-time credits (discount line items off commitment that drop off at renewal).

This is a good option for customers who cannot make annual commitments, value flexibility, or have unpredictable growth.

Commitment contracts

With commitment contracts, the vendor and customer create an estimate of long-term expected usage and agree on a payment commitment. Typically, if a customer’s usage exceeds that commitment, the vendor bills the excess usage at previously agreed-upon rates. It might also offer discounts with varying degrees of flexibility, such as:

- Savings plans, which provide a minimum spend commitment in exchange for discounted rates. Some vendors provide the ability for customers to use an annual or multi-year pool of funds for any combination of usage across the entire term. Just one observability vendor—New Relic—offers an automatic rollover of unused funds for the duration of the multi-year contract term.46 They should also provide customers a termination right once they exceed their spend commitment. Benefits include no shelfware at the end of the contract term, de-risking of larger commitments with longer-term contracts, and flexible contract options. A savings plan is a good option for customers who view their observability vendor as a strategic partner and want to expand/scale.

- Volume plans, which provide a negotiated commitment for each product based on how it’s priced (for observability, typically that would be by infrastructure, services, users, and/or telemetry data) that make budgeting and planning easy. In other words, it provides deeper bundled discounts to customers that pre-commit to volume for each product. It may offer one-time credits (discount line items off commitment that drop off at renewal). A volume plan is a good option for customers who see observability as a cost to manage, are unwilling or unable to commit to expanding spend or invest behind programs, prioritize spend predictability, or are willing to trade off flexibility for predictability. For user-based pricing models, it also helps customers give access to all engineers.

Both plans may offer early renewal before pool depletion (rip and replace) and contract top-ups (adding to annual committed revenue (ACR) without changing contract start or end dates). Both plans may also only be available for certain pricing editions.

Evolution of software pricing and billing models

Generally, software vendors are evolving from on-prem to SaaS business models, closed to open software ecosystems, infrastructure- to usage-based pricing models, and subscription- to usage-based billing models.

Software vendors have relied on a subscription billing model since the early days of SaaS. AWS pioneered the move to a usage-based model where usage is tied to value, followed by other vendors such as Twilio, Stripe, Snowflake, Cypress, HubSpot, IBM, Google, Microsoft, and more.

The trend towards a usage-based model is strong and has quickly gone from fringe to mainstream. It’s the norm for infrastructure and is also popular for middleware and application software. A 2021 report by OpenView found that 45% of SaaS companies had a user-based model in 2021, up from 34% in 2020 and 30% in 2019. It also found that “The fastest-growing companies are especially likely to leverage usage-based pricing, which coincides with best-in-class cost of customer acquisition (CAC) payback and net dollar retention (NDR).” It projects usage-based adoption to grow 56–79% by 2023. And 61% of respondents expected to test or introduce it in the next six to 12 months.47

According to an IDC survey, 61% of enterprises agreed that their organizations are aggressively shifting toward paying for technology services based on consumption.48

As organizations look to ramp up their observability capabilities, it’s important to get maximum value from the investment. The 2021 Observability Forecast found that a move to modern observability includes a shift from a legacy subscription-based model (65% of respondents) to a modern consumption-based model (23% of respondents) that aligns an observability vendor’s interests with customer success.49

The move to a usage-based model started with the insight that the pricing model for observability tooling was broken across the industry. Instead of continuing to implement misaligned pricing meters and expensive licenses associated with the subscription model, the observability industry is beginning to make the shift to a consumption model.50

New Relic spearheaded this industry-wide shift by introducing consumption pricing and billing in July 2020.51 Based on customer feedback and extensive research, it switched from the standard infrastructure-based, bundle-of-SKUs pricing model and subscription-based billing model to a hybrid user- and telemetry-based pricing model and usage-based billing model. The switch to a usage-based model is paying off as customers find that it provides more value for their money.52

Most observability vendors continue to refine their pricing and billing models to address customer needs. For example, in 2022, New Relic introduced tiered user pricing, a savings plan, and a volume plan to improve the effectiveness and predictability of per-user pricing. Tiered pricing improves the economics of scaling to larger user commitments. The savings plan provides more flexibility, such as an annual or multi-year pool of funds with an automatic rollover of unused funds. The volume plan provides a negotiated commitment of both users and data that makes budgeting and planning easy.

Top 10 pricing and billing questions

When evaluating observability vendors, organizations must consider many different aspects, including product capabilities and security, support, training, and implementation options. In addition to considering the business model, software ecosystem, pricing model, pricing options, billing model, and buying programs in the comparison table above, it’s also important to ask the right pricing and billing questions:

- Do they charge for different units per monitoring capability or is there an all-in-one price?

Remember, many observability vendors price capabilities per SKU (each can have multiple different units and pricing modifiers) per quantity each for a monthly use-it-or-lose-it amount. While an observability platform provides access to all capabilities through an all-in-one price. And its data SKU is not tied to a particular use case, so it can be used for any use case over the contract term. - How much will it cost?

Look for a vendor that offers transparent, budget-friendly pricing—including a low data cost per GB and reasonable costs for infrastructure, services, or users—and a low-cost entry point. Keep in mind that some vendors seem to have affordable pricing at first glance, but they bury hidden costs, overage fees, and penalties in the contract terms. Watch out for traps like bait-and-switch pricing (low entry costs but expensive add-ons), bundling adjacent use cases, forcing features to be enabled, having many SKUs with no substitution options, forcing premium SKUs when they're not required, penalties for exceeding monthly commitments, resizing the unit count when a modifier is exceeded, paying a higher rate once billing limits have been exceeded, paying for user access more than once, paying extra for OpenTelemetry, data egress fees, and additional fees to index, retain, or rehydrate logs. - Do they have a single license metric across all telemetry?

Regardless of the capability or telemetry type, the vendor should ideally charge a common per-GB price for data ingest. For example, some vendors charge based on hosts in one area, data ingest in another, spans in a third, and so on. - What limits do they need to be aware of, and how much does it cost if customers exceed them?

As part of their pricing models, observability vendors may include freemium limits for data ingest, data retention, containers, custom metrics, synthetic checks, and more. To avoid surprise costs, it’s important to consider these limits and the associated costs for exceeding them when forecasting budgets. - How easy or difficult is budget forecasting?

The ability to predict accurately what the bill will be in advance is important. Spending months forecasting an observability budget can be further frustrating when hit by surprise overages. Some observability vendors require customers to forecast their usage based on historical usage, which is especially hard for those experiencing rapid growth. Look for a pricing model that’s weighted based on stable pricing units. - Do they have the flexibility to scale usage based on consumption with no monthly minimum?

This is especially important for those that have unpredictable usage, such as startups, teams working on incubator projects, and enterprises with extremely spiky workloads that only want to pay for what they use. - Do they offer the ability to burst (autoscale without penalty)?

For any pricing unit, customers should be able to burst during seasonal spikes or unpredictable workload increases. For example, charging per container places a configuration burden on engineering teams since some observability vendors charge a premium for more than four containers running continuously on an APM host. - Do they bill for peak usage, average usage, or actual usage?

Ask how they handle seasonality, blue/green deployments, and traffic spikes. Some observability vendors price by high watermark (peak) usage instead of average usage. Spikes can double the bill. - With a pool of funds option, what happens with unused funds, and, conversely, when customers exceed the spend commitment?

Ideally, customers should be able to roll over unused funds automatically, terminate or renew the contract, or add more funds once they exceed their spend commitment. Benefits include no shelfware at the end of the contract term, de-risking of larger commitments with longer-term contracts, and flexible contract options. - Do they provide tools to query, track, and alert on billing-related usage?

Tools to query, track, and alert on billing-related usage are a best practice because they make accurate sizing and pricing easier. For example, organizations should be able to create an alert when data usage exceeds a fixed monthly threshold for gigabytes. Unfortunately, not all observability vendors provide these tools, so ask whether they do and, if so, how.

Conclusion and recommendations

Based on the research presented in this white paper, we recommend the following pricing and billing options:

- Business model: SaaS

- Software ecosystem: Open

- Pricing model: User- and telemetry-based

- Billing model: Usage-based

- Buying program and pricing options: Depends on the needs of the organization

As the vendor comparison chart shows, New Relic is the only observability vendor that currently offers all of these options. It bases its straightforward pricing on just two core metrics—users and data ingest—which makes it easy for customers to understand what they’re paying for.

New Relic has a competitive pricing model. While the majority of its competitors offer a complex pricing model with separate costs per service, the New Relic offering is only based on the number of users and ingested data. It was very predictable…[and] the pricing was less burdensome compared to competitors and, overall, more cost-effective. [With New Relic,] we can…quickly respond to all obstacles in one place through a predictable pricing model.

In addition, cost comparisons show that the total cost of ownership (TCO) with New Relic is lower than alternatives as organizations standardize and scale their observability practices.53 This TCO advantage is because New Relic spend scales with true usage. Organizations pay a single, low rate for data and a one-time price for each engineer to access all 30+ observability capabilities (data grows faster than users). Customers are in control as they can increase or decrease their data usage and add and remove users as needed. In addition, every engineer can access alerts, dashboards, queries, and basic logs for free on the New Relic observability platform. They can upgrade users who need additional access to provisioned users. And New Relic offers tiered pricing, volume plans, and savings plans to make observability for all affordable and easy to scale.

This simple model is widely regarded as superior to legacy agent-/host-based pricing as it addresses three predatory pricing traps:

- Peak billing: Avoids excessive payments when infrastructure scales up and provides the ability to pay only for actual monthly usage.

- Surprise overages: Avoids getting hit by unbudgeted overages after spending weeks imprecisely forecasting the annual spend for each SKU.

- Contract for 16+ SKUs: Avoids individually negotiating and paying for each SKU with different pricing models and traps as organizations scale.

New Relic is leading the game with no hidden overage fees or penalties and full visibility with real-time usage reporting. Unlike some other observability vendors, there’s no bait-and-switch pricing. And its data SKU is not tied to a particular use case, so it can be used for any data-generating use case over the contract term. With New Relic, organizations get unlimited hosts, agents, containers, devices, AWS Fargate tasks, cloud functions, and more included in its offering at no additional cost. Plus, it includes many new features and capabilities.

New Relic pricing and billing for its all-in-one observability platform help customers attain end-to-end, full-stack observability for all engineers—without breaking the bank. This, in turn, can lead to a host of benefits, including better cross-team engagement and collaboration as well as improved uptime, performance, reliability, operational efficiency, customer experience, innovation, and business and/or revenue growth.54

Próximos passos

Learn about New Relic pricing.

Or better yet, sign up for a free New Relic account, ingest your data, and start reaping the benefits of observability today.

References

Ahmed, Shoeb. 2020. “The Ultimate Guide to SaaS Pricing Models.” SmartKarrot. https://www.smartkarrot.com/resources/blog/saas-pricing-models.

Basteri, Alicia. December 2022. What Makes Observability a Priority. N.p.: New Relic. https://newrelic.com/resources/white-papers/observability-as-a-priority.

Basteri, Alicia, and Daren Brabham, Ph.D. September 14, 2022. 2022 Observability Forecast. N.p.: New Relic. https://newrelic.com/observability-forecast/2022/about-this-report.

Baum, Michael, Joydeep Bhattacharya, Rob Das, and Erik Swan. 2020. “Is Netflix a SaaS? 25 Examples of SaaS Companies that Are Rocking It.” Single Grain. https://www.singlegrain.com/saas/examples-of-saas-companies.

BillingPlatform. 2022. “3 Ways Usage-Based Pricing Offers Higher Revenue Than Pure Subscriptions.” BillingPlatform. https://billingplatform.com/blog/usage-based-pricing-offers-higher-revenue-than-pure-subscriptions.

Cisco AppDynamics. n.d. “AppDynamics Pricing.” AppDynamics. Accessed November 10, 2022. https://www.appdynamics.com/pricing.

Cite Research and New Relic. September 14, 2021. 2021 Observability Forecast. N.p.: New Relic. https://newrelic.com/resources/report/2021-observability-forecast.

Datadog. n.d. “Datadog APM.” Datadog Docs. Accessed November 10, 2022. https://docs.datadoghq.com/tracing.

Datadog. n.d. “Datadog APM Pricing.” Datadog. Accessed November 10, 2022. https://www.datadoghq.com/pricing/?product=apm--continuous-profiler.

Datadog. n.d. “Datadog Log Management Billing.” Datadog Docs. Accessed November 10, 2022. https://docs.datadoghq.com/account_management/billing/log_management.

Datadog. n.d. “Datadog Log Management Pricing.” Datadog. Accessed November 10, 2022. https://www.datadoghq.com/pricing/?product=log-management#log-management.

Datadog. n.d. “Datadog Pricing.” Datadog. Accessed November 10, 2022. https://www.datadoghq.com/pricing.

Datadog. n.d. “DogStatsD.” Datadog Docs. Accessed November 10, 2022. https://docs.datadoghq.com/developers/dogstatsd/?tab=hostagent.

Degnan, Chris. 2021. “Consumption-based Pricing: Ensuring Every Customer's Success.” Snowflake. https://www.snowflake.com/blog/consumption-based-pricing-ensuring-every-customers-value-and-success.

de Jesus, Charles. 2022. “The business benefits of consumption pricing.” ARN. https://www.arnnet.com.au/brand-post/content/694471/the-business-benefits-of-consumption-pricing.

Dynatrace. n.d. “Dynatrace OneAgent.” Dynatrace. Accessed November 10, 2022. https://www.dynatrace.com/support/help/setup-and-configuration/dynatrace-oneagent#dynatrace-oneagent.

Dynatrace. n.d. “Dynatrace Pricing.” Dynatrace. Accessed November 10, 2022. https://www.dynatrace.com/pricing.

Elasticsearch. n.d. “Elastic Pricing FAQ.” Elastic. Accessed November 10, 2022. https://www.elastic.co/pricing/faq.

Gilbert, Nestor. 2022. “11 SaaS Software Trends for 2022/2023: New Forecasts You Should Know.” FinancesOnline.com. https://financesonline.com/saas-software-trends.

Gold, Carl, and JJ Xia. n.d. Subscription Economy Benchmark: Usage-based Pricing. N.p.: Zuora. https://info.zuora.com/rs/602-QGZ-447/images/Zuora_SEB2_Usage_Based_Pricing.pdf.

Grieser, Tim. October 2021. Worldwide IT Operations Analytics Software Forecast, 2021–2025. N.p.: IDC. https://www.idc.com/getdoc.jsp?containerId=US48251621.

Johnston Turner, Mary. March 2021. Consumption-Driven Digital Infrastructure Subscriptions Are a Priority in 2021. N.p.: IDC. https://www.idc.com/getdoc.jsp?containerId=US47568621.

Kalevar, Sanjiv, and Kyle Poyar. November 2021. The 2021 State of Usage-Based Pricing. N.p.: OpenView Advisors. https://openviewpartners.com/blog/2021-state-of-usage-based-pricing.

Kalevar, Sanjiv, and Kyle Poyar. January 2021. The Usage-Based Pricing Playbook. N.p.: OpenView Advisors. https://offers.openviewpartners.com/usage-based-pricing-playbook.

Khurana, Manav. 2020. “Troubleshoot your stack, not your monitoring bill.” New Relic. https://newrelic.com/blog/nerdlog/simple-pricing.

Khurana, Manav, and Alicia Basteri. 2021. “Usage-based pricing: Get more value for your money.” New Relic. https://newrelic.com/blog/nerdlog/consumption-pricing-offers-more-value.

Kozminski, Anna. 2016. “Embracing Open, Collaborative Ecosystems Is Good Business.” Electronic Design, May 12, 2016. https://www.electronicdesign.com/technologies/systems/article/21801506/embracing-open-collaborative-ecosystems-is-good-business.

Mukherjee, Ishan, and Alicia Basteri. 2021. “Cost Comparison for New Relic, Datadog, and Dynatrace.” New Relic. https://newrelic.com/blog/nerdlog/cost-comparison-new-relic-vs-datadog-vs-dynatrace.

New Relic. February 4, 2021. New Relic Investor Letter Third Quarter Fiscal Year 2021. N.p.: New Relic. https://s201.q4cdn.com/294716384/files/doc_financials/2021/q3/NR_3Q_FY21_Investor_Letter-v15.pdf.

New Relic. n.d. “New Relic Pricing.” New Relic. Accessed November 10, 2022. https://newrelic.com/pricing.

New Relic. n.d. “New Relic Pricing and Billing.” New Relic Documentation. Accessed November 10, 2022. https://docs.newrelic.com/docs/accounts/accounts-billing/new-relic-one-pricing-billing/new-relic-one-pricing-billing/#tiered-pricing.

New Relic. n.d. “New Relic Usage-Based Plan Descriptions.” New Relic Documentation. Accessed November 10, 2022. https://docs.newrelic.com/docs/licenses/license-information/usage-plans/new-relic-one-usage-plan-descriptions/#savings-plans.

Pandab, Prangya. 2022. “Three Reasons Why Data-Driven Observability Landscape Will Gain Momentum in 2022.” Enterprise Talk. https://enterprisetalk.com/featured/three-reasons-why-data-driven-observability-landscape-will-gain-momentum-in-2022.

Patrizio, Andy. 2022. “Top SaaS Companies of 2022.” Datamation. https://www.datamation.com/cloud/saas-companies.

Poyar, Kyle. 2021. “Companies With Usage-Based Pricing Grow 38% Faster.” OpenView. https://openviewpartners.com/blog/usage-based-pricing-growth.

Ross, Lisa, Khalid Saleh, and Ayat Shukairy. n.d. “The State of SaaS Pricing Strategy—Statistics and Trends.” Invesp. https://www.invespcro.com/blog/saas-pricing.

Splunk. n.d. “Splunk Observability Pricing.” Splunk. Accessed November 10, 2022. https://www.splunk.com/en_us/products/pricing/observability.html.

Splunk. n.d. “Splunk Usage Subscription Limits Enforcement and Entitlements.” Splunk. Accessed November 10, 2022. https://www.splunk.com/en_us/legal/usage-subscription-limits-enforcement-and-entitlements.html.

Subscribed Institute. March 2021. The Subscription Economy Index™. N.p.: Zuora. https://info.zuora.com/rs/602-QGZ-447/images/Zuora_SEI_2021_web.pdf.

Tzuo, Tien. 2021. “How To Adopt Usage-Based Pricing: Lessons from New Relic.” Subscribed Weekly, November 6, 2021. https://www.subscribed.com/read/news-and-editorial/how-to-adopt-usage-based-pricing-lessons-from-new-relic.