As I meet with developers, executives, and partners operating digital enterprises across the globe, one thing is clear—every engineering team is being asked to do more with less. Budgets are shrinking, headcount is going away, and in some cases, engineers are being let go. If you’re in that situation, this blog can help.

This time reminds me of 2008–2010 when a similar economic downturn had businesses of all sizes wrestling with budgets and looking for efficiencies. Do you remember where you were, around that same time, when you first heard of Amazon Web Services (AWS) and the cloud consumption model?

I remember I was sitting in a conference room listening to an AWS product manager describe how Amazon.com's large e-commerce presence had forced the company to provision enormous quantities of compute, network, and storage infrastructure to ensure enough capacity for peak retail seasons, only to see most of it sit idle for a majority of the year. For Amazon, this represented both a problem and an opportunity. How could they turn a huge capital expense into a business opportunity?

The answer was simple: turn that spare capacity into a pay-for-usage service where Windows and Linux hosts were available for rent by the hour. I was stunned. At the time I worked at Microsoft and knew that the dominant way to purchase Windows was through a host-based licensing model. So while all those Windows hosts were making Microsoft money, whether they were being used or not, they were costing customers. The new usage-based approach was an entirely different way to spin up machines on demand, enabling customers to pay only for what they use, when they need it. And with that simple idea, a multi-trillion-dollar industry was born, representing the largest disruptive force in technology for the past decade.

It’s a bit ironic then, as we sit here in 2023 amidst the most significant uncertain economic period we’ve experienced in a decade, that the majority of observability vendors are still stuck charging customers by the host—in fact, some charge at peak host count for the entire month, even if you scale up for just one day! Even Azure doesn’t charge for Windows that way anymore.

We know the host-based pricing model well. We led the application performance monitoring (APM) market with it for more than a decade. But we listened to our customers, studied the industry, and knew it was time to introduce a better way.

Our all-in-one platform pricing model—which is based on two core metrics, users and GBs, instead of hosts—isn’t just a different way to price, it’s better. It delivers more value per dollar.

Are you tired of surprise bills and ballooning observability costs?

We’ve seen many teams consolidating their Datadog, Elastic, Sumo Logic, and open-source monitoring tools to New Relic and saving money because of five key factors:

- No peak billing: Pay for actual usage, avoid peak usage billing when environments scale up.

- No penalties: Predictably forecast spend and avoid overages for specific data types like custom metrics.

- Low infra monitoring cost: Get 3x+ more value than host-based pricing vendors like Datadog.

- Low log management cost: Get 2–4x more value than Sumo Logic and 2–3x more value than Elastic.

- Low overall total cost of ownership (TCO): Get 5x+ more value than Datadog as you consolidate all observability needs in one platform.

Let me explain them one by one.

Paying for actual usage, not peak usage

Most customers now scale their infrastructure based on customer traffic. Observability vendors with legacy host-based pricing models (like Datadog, Elastic, and Splunk) price by high watermark (peak) usage instead of actual usage.

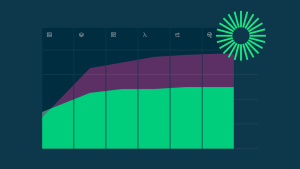

For example, Datadog prices per host at the 99% highest usage hour for the month.1 As shown in the chart below and the underlying spreadsheet, a representative customer's monthly bill is 44% higher than the commitment as the environment scales up with customer traffic. In the same period, the New Relic bill is 2x less expensive than the commitment and 3x+ less expensive than the actual bill because New Relic charges for actual usage at a single low price per GB.

Comparison of monthly Datadog bill (99% peak usage) and New Relic (actual usage) based on published prices

Predictable spend, no overages or penalties

Some observability vendors bury hidden costs, overage fees, and penalties in the contract terms.

With New Relic, all telemetry sources are priced at the same rate without any penalties. As shown in the chart below based on a full-stack observability price comparison, alternate pricing models like those of Datadog and Dynatrace charge for custom metrics and third-party data separately and at a higher rate than host-based prices. This can result in up to 50% of your invoices being made up of surprise costs for data sources that are now considered standard by all engineering teams.

Detailed breakdown of estimated monthly full-stack observability and customer metrics costs of Datadog and Dynatrace for small, midsize, and large engineering teams

Instead of pricing each capability as a separate SKU, like other vendors on the market, with New Relic, an organization only pays for what it uses with no overage penalties.

Low incremental cost for infrastructure hosts

Legacy host-based pricing can disincentivize you from expanding your observability coverage beyond the set of hosts you can afford to deploy agents on. With vendors like Datadog, per-host prices can range from $152 to $843 per host per month. The Dynatrace per-host APM pricing is based on system memory and can run into thousands per month.4 With New Relic, the equivalent monthly per-host pricing is approximately $4/host.5

A comparison of infrastructure monitoring costs shows that New Relic can provide up to 3x more value than Datadog. Your engineering teams can leverage the scalability of New Relic pricing to expand observability coverage to all needed workloads without pricing constraints.

New Relic has a competitive pricing model. While the majority of its competitors offer a complex pricing model with separate costs per service, the New Relic offering is only based on the number of users and ingested data. It was very predictable…and, overall, more cost-effective.

Low incremental cost for log management

With accelerated cloud migration and digital transformation, customers report 2–10x increases in telemetry data volume. Therefore, it’s important to future-proof cloud adoption with an observability vendor like New Relic that offers a low data cost per GB. This is best demonstrated with log data where customers have transitioned off of legacy logging solutions to New Relic and realized significant savings.

A comparison of log management costs shows that AWS CloudWatch can be up to 2x more expensive than New Relic, and Datadog can be up to 4x more expensive than New Relic. The charts below based on the underlying spreadsheet show that Sumo Logic logs can be 2–4x more expensive than the New Relic all-in cost and Elasticsearch, Logstash, and Kibana (ELK) logs can be 2–3x more expensive.

Comparison of monthly log costs for New Relic versus Sumo Logic based on published prices and hypothetical customer usage data

Comparison of monthly log costs for New Relic versus ELK based on published prices and hypothetical customer usage data

For example, Simply Business was using multiple tools for logs—including ELK—and was on track to spend a million dollars per year on observatory tools alone, which was unsustainable and lacked the return on investment (ROI) to justify it. After switching to New Relic log management, Simply Business DevOps engineer Mikio Tsunematsu said, “Focusing on one tool has saved us money as well as mental energy.”

New Relic is changing the economics of observability by empowering companies to leverage all available telemetry at a dramatically lower cost than before.

Low overall TCO

According to the 2022 Observability Forecast survey, organizations with a single observability tool were the most likely to say that business and/or revenue growth is a primary benefit enabled by their observability deployment (36%).

As customers consolidate their full-stack observability needs in New Relic, they can realize up to 5x more value for money than tools from vendors like Datadog.

Comparison of estimated monthly full-stack observability costs of New Relic, Dynatrace, and Datadog for small, midsize, and large engineering teams

An IDC study found that certain New Relic customers:

- Reduced the annual frequency of unplanned outages by 49% and remediated disruptive events 69% faster, which boosted staff productivity by 88% and translated into an average annual salary savings of $853,000 per organization.

- Gained 1% in gross productivity and 61 productive hours, which translated into an annual productivity-based business value of $1.8M.

| Team | Avg. productivity increase | Avg. annual salary savings |

|---|---|---|

| TeamAppDev and DevOps | Avg. productivity increase16% | Avg. annual salary savings$1.0M |

| TeamIT engineer | Avg. productivity increase43% | Avg. annual salary savings$1.3M |

| TeamIT infrastructure | Avg. productivity increase16% | Avg. annual salary savings$239,900 |

The total average additional annual revenue projected with New Relic was $4.4 million. IDC projected these levels of benefits and investment costs to result in an average three-year ROI of 357% with a break-even point occurring in about five months.

While not every customer may see the same level of TCO reduction, here are a few really powerful examples:

- IGS reduced monitoring and logging costs from 20–24K GBP per month to 8–10K GBP per month.

- movingimage rightsized each Kubernetes (K8s) container environment, cut the number of nodes and corresponding wasted cloud compute resources and costs in half, and reduced K8s monitoring spend by 50%.

- PicPay increased new revenue generated from existing customers and revenue generated from new customers by 10%, improved customer attrition rate by 10%, improved revenue leakage rate by 20%, realized a 191% ROI, and helped set up for even greater gains in the business life cycle.

More value with usage-based pricing and billing

According to the 2022 Gartner® Magic Quadrant™ for APM and Observability, “New Relic offers a clearly differentiated and disruptive pricing model in the field that has contributed to its recent growth in the number of accounts. This model is increasingly resonating with clients looking to manage ever-increasing monitoring bills.”

Next steps

New Relic customers: Don’t resort to sampling and lose visibility because you are paying too much for all those other legacy host-based monitoring and observability tools beyond New Relic. We can help reduce your total observability spend by bringing all of your telemetry data and engineers into one place—making them more productive—and save you money.

If you don’t currently use New Relic, you can learn more about New Relic user- and usage-based pricing and billing and sign up for a free account to try it yourself (no credit card required!). See our guide to making the switch to get started!

You may also be interested in this white paper about what makes observability a priority—and why pricing and billing can be a barrier to achieving it. The Best Pricing and Billing Models for Observability white paper has additional details, including the top 10 pricing and billing questions to ask.

And if you’re interested in learning how much you can save, contact us and we’ll help you estimate the savings and plan your migration today!

References

Datadog. n.d. “Datadog Billing.” Datadog Docs. Accessed January 24, 2023. https://docs.datadoghq.com/account_management/billing/.

Datadog. n.d. “Datadog Database Monitoring Pricing.” Datadog. Accessed January 23, 2023. https://www.datadoghq.com/pricing/?product=database-monitoring#database-monitoring.

Datadog. n.d. “Datadog Infrastructure Pricing.” Datadog. Accessed January 23, 2023. https://www.datadoghq.com/pricing/?product=infrastructure#infrastructure.

Dynatrace. n.d. “Dynatrace Pricing.” Dynatrace. Accessed January 24, 2023. https://www.dynatrace.com/pricing/.

New Relic. n.d. “Full-Stack Observability Price Comparison.” New Relic. Accessed January 23, 2023. https://docs.google.com/spreadsheets/d/13-GTHZOfhuC78efXGVr89KLKzHKoa_HetjX9Hm4ZaU4/edit?usp=sharing.

The views expressed on this blog are those of the author and do not necessarily reflect the views of New Relic. Any solutions offered by the author are environment-specific and not part of the commercial solutions or support offered by New Relic. Please join us exclusively at the Explorers Hub (discuss.newrelic.com) for questions and support related to this blog post. This blog may contain links to content on third-party sites. By providing such links, New Relic does not adopt, guarantee, approve or endorse the information, views or products available on such sites.

Please refer to the linked spreadsheet for additional details and assumptions regarding these calculations. Prices, including ones provided as a promotion, are subject to change. The relative value calculations in these tables are based on the additional New Relic users and data that could be purchased with the cost savings reflected in these scenarios. The New Relic data ingest cost (standard retention) was updated on May 8, 2022, based on ingest pricing updates.

All dollar amounts are in USD unless otherwise noted. This blog post contains “forward-looking” statements, as that term is defined under federal securities laws, including but not limited to statements regarding the anticipated benefits and value propositions of the New Relic usage-based pricing model. The achievement or success of the matters covered by such forward-looking statements are based on New Relic current assumptions, expectations, and beliefs and are subject to substantial risks, uncertainties, assumptions, and changes in circumstances that may cause New Relic actual results, performance, or achievements to differ materially from those expressed or implied in any forward-looking statement. Further information on factors that could affect New Relic financial and other results and the forward-looking statements in this post is included in the filings New Relic makes with the SEC from time to time, including in the most recent New Relic Form 10-Q, particularly under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Copies of these documents may be obtained by visiting the New Relic Investor Relations website at http://ir.newrelic.com or the SEC website at www.sec.gov. New Relic assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

All third-party trademarks (including logos and icons) referenced by New Relic remain the property of their respective owners. Unless specifically identified as such, New Relic’s use of third-party trademarks does not indicate any relationship, sponsorship, or endorsement between New Relic and the owners of these trademarks. Any references by New Relic to third-party trademarks are to identify the corresponding third-party goods and/or services.